Car insurance is tricky, especially if you are a new car owner. Things might get a bit clearer if it’s your second or third purchase, but we have observed that applicants still get stuck or suffer from a few common issues. In today’s article, we’ll discuss areas where a prospective car insurance applicant gets stuck or is usually confused.

But we get started, we’d recommend that you go through our previous blogs on car insurance, its need, a step-by-step guide on insuring your car, and the difference between CTPL and comprehensive insurance. All this will help you get a fair idea about car insurance in the Philippines and give you confidence to go about the process.

However, like many, if you don’t have the time and patience to sit and read through blogs after blogs, here’s a quick refresher for you.

Car insurance - An overview

Car insurance is nothing but a shield, a safety net that offers financial protection against unexpected events leading to car damage. The events may include a car accident, natural disaster, theft, fire, riots, etc. Every driver should get car insurance, wherein they are required to make regular payments to get financial assistance needed by filing a claim.

Car insurance in the Philippines

We are not sure about others, but here in the Philippines, car insurance is a mandatory requirement. So much so that you can’t even register your car at the LTO without CTPL insurance. Wondering what CTPL is and what other insurance policies are available in the Philippines. Here are several car insurance coverage options available in the Philippines -

- Compulsory Third Party Liability (CTPL) Insurance - In the Philippines, CTPL insurance is mandatory by law and, as mentioned, is a prerequisite for car registration and renewal. As for coverage, CTLP offers financial protection against third-party injury/death involving the insured car.

- Comprehensive Insurance - Unlike CTPL, comprehensive insurance is optional; you can decide to get it or leave it altogether. Experts, however, recommend that car owners get comprehensive coverage as it offers protection against a wide range of incidents, like theft, fire, flood, riot, etc.

- Add-ons - In addition to comprehensive car insurance, insurance providers also offer add-on coverage (obviously at an extra premium), which you can get after evaluating your requirements. Some of the common add-on insurances include Acts of God, Roadside Assistance, Towing Service, Loss of Use, and Personal Accident Coverage, to name a few.

Photo from coverlink

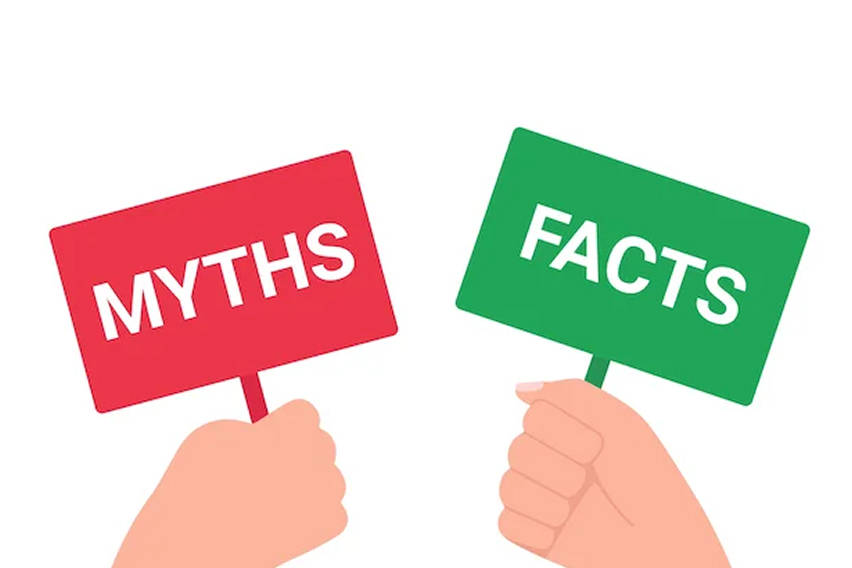

Photo from coverlinkReasons for myths/misconceptions around car insurance

Despite all the knowledge and so many insurance companies in the country, several misconceptions persist around car insurance. Thus leading to poor decision-making and costly decisions. The reason behind the issue can be -

- Lack of financial know-how

- Limited trust or communication with the insurance provider

- Outdated experience shared by friends or family

- Misinformed by peers

Myths around car insurance in the Philippines

| Myth | Reality |

| Car insurance only offers protection against accidents | It is a widely accepted notion that car insurance only covers road accidents. However, in reality, comprehensive insurance covers theft, flood, riot, vandalism, etc. |

| CTPL insurance is enough | Not at all. CTPL insurance only covers third-party injuries/death. No protection for you or your car in case of an accident or any unfortunate event involving your car. |

| Comprehensive insurance covers all you need | Many believe that comprehensive insurance covers all bases. But that’s not true and highly misleading, leading to unwelcome surprises during claim filing. It is therefore advisable to read the fine print before signing the contract. |

| An old car needs no insurance | It is believed that old car owners can skip insurance altogether. But that’s not the case; older cars are expensive to repair, and if stolen or damaged, insurance can save you thousands of pesos. |

| Car insurance is expensive | Many think car insurance is a total waste of money. However, in reality, the basic insurance plan is quite affordable. |

| Premium automatically raises after a claim | No insurance provider will raise your premium amount automatically after you have filed a claim. Your insurer will first assess the claim based on the nature of the incident, the level of your fault, and your claim history. If you are the one found at fault, the premium will rise. |

| Everything can be covered under car insurance. | Sadly, that is not the case, no matter the inclusions in your comprehensive policy and the add-ons. Incidents like drunk driving, racing, a car in the hands of an unauthorised driver, and wear and tear are not covered. It is better to go through the scope and limitations of the policy. |

| Go with the cheapest option, it’s fine. | Going with the cheapest policy can leave you underinsured. You might have to face poor service and a slow claim process. |

| Car theft is a default coverage. | Car theft is not a default coverage. If you need such protection, go with a comprehensive plan with this inclusion or a specific add-on. |

How to spot and avoid insurance scams

- Make sure the selected car insurance provider has a valid and existing certificate of authority.

- Before committing, make sure to read online reviews for existing or past customers.

- Do not fall for a cheap insurance policy, as they can prove costly in the long run.

- Read the fine print thoroughly, go through every clause, fee, and penalty closely.

- Do not fall prey to a middleman demanding upfront cash.

- Educate yourself about car insurance, which will also lead to better protection, financial savings, and the ability to make smarter choices that fit your needs.

Tips to choose the right car insurance policy

- First and foremost, analyse your car insurance-related needs.

- Search for different car insurance providers and get quotes.

- Compare quotes from different providers along with policy inclusions and exclusions.

- Check the insurance provider’s reputation, customer service, and feedback.

Bottom line

Getting your car insured may sound easy, but in reality is an uphill battle. In addition to all the confusion related to car insurance providers, a suitable policy, and reviewing the contract, you might still have several apprehensions. The entire process becomes all the more difficult if you are a new driver, but there’s nothing to fear. Just follow our step-by-step guide on car insurance in the Philippines, and try to stay clear of all the above-mentioned myths - that’s it, you are sorted.

FAQs

Will my credit score have any impact on my car insurance premium?

Yes. While a lower credit score will result in a high premium, a higher score will offer the benefit of lower insurance costs.

I am an old driver, will I have to pay a higher premium?

Not all old drivers are required to pay a high premium. Insurance companies usually evaluate the premium based on the applicant’s driving history, claim history, etc.

What is an accident forgiveness program?

Some insurance providers in the country offer an accident forgiveness program, wherein the first claim does not impact your premium. Typically, drivers fear that filing a claim will automatically hike the premium amount.

Are personal belongings covered under a car insurance policy?

Typically, a car insurance policy in the Philippines does not offer protection against damage or stolen belongings inside the vehicle.

Is car insurance a must in the Philippines?

Yes, a Filipino car owner is required to get CTPL insurance for vehicle registration.

Is it possible to reduce my car insurance premium?

Yes, you just need to maintain a clean driving record and bundle policies.