ZenInsure Benefits

Our insurance goes beyond standard protection to give you complete peace of mind

Pay your way with easy monthly installments or one-time full payment — choose what suits your budget and convenience.

Get quick, summarized quotes with unbeatable rates and top-tier service from trusted providers - all in one place.

No hidden fees. No surprises. You only pay what you see - simple, clear, and honest pricing.

Compare multiple insurers, rates, and promos instantly. More options mean better chances of finding the perfect car insurance for you.

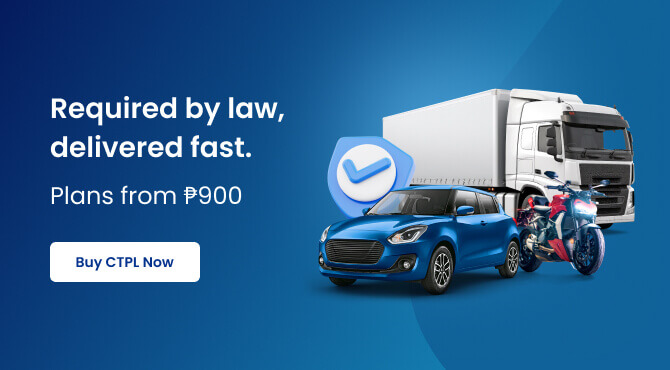

Why Choose ZenInsure for CTPL Insurance?

Protect your vehicle without breaking the bank. ZenInsure offers CTPL coverage at competitive rates - plus 24/7 support whenever you need it.

We help you meet all Land Transportation Office requirements for CTPL insurance - fast, easy, and fully compliant.

Get insured in minutes. Our digital process makes it simple to secure your CTPL policy - no long lines, no hassle.

Join thousands of satisfied drivers who rely on ZenInsure for hassle-free and dependable CTPL protection.

What Does CTPL Insurance Cover?

CTPL Insurance is mandatory for all vehicle owners in the Philippines and provides coverage for:

Covers medical expenses and death benefits for individuals injured or killed in an accident involving your vehicle.

Support for legal defense and claims if a third party takes legal action against you.

Optional coverage that protects your vehicle’s passengers in the event of an accident.

Enjoy dedicated assistance from our team for claims, policy inquiries, and renewals.

How to Get CTPL Insurance with ZenInsure

Step 01

Step 01

Fill in your vehicle and personal information, then select your preferred insurance provider for the best match

Step 02

Step 02

Upload a clear copy of your OR/CR and a valid government-issued ID for quick verification

Step 03

Step 03

Once your documents are verified, your CTPL policy will be issued within 2 hours and sent directly to your email

Our Trusted Insurance Partners - Ensuring Your Safety

We are Certified and Accredited

ZenInsure (operated under OTO Insurance Agency Corporation) is a licensed insurance agency regulated by the Insurance Commission of the Philippines.

IC Reg. No.: 1861074-7080529-200013

ZenInsure is also officially registered with the Securities and Exchange Commission (SEC) in the Philippines under OTO Insurance Agency Corporation.

SEC Reg. No.: 2024040144280-02CTPL Insurance Pricing Guide

| Vehicle Type | 1-Year Premium | 3-Year Premium |

|---|---|---|

| Passenger Vehicles | ₱599.00 | ₱1,660.00 |

| Commercial - Light/Medium | ₱660.00 | ₱1,800.00 |

| Commercial - Heavy | ₱1,250.00 | ₱3,490.00 |

| Motorcycles | ₱300.40 | ₱770.40 |

Compare CTPL & Comprehensive Insurance Coverage

| Feature | CTPL | Comprehensive |

|---|---|---|

| Third-Party Injury Cover | ||

| Own Damage Protection | ||

| Theft Protection | ||

| Natural Disaster Coverage | ||

| Roadside Assistance |

Coverage and pricing may vary depending on the vehicle type, insurer, and selected plan. Always review the policy details before purchase. Need more protection? Upgrade to Comprehensive Insurance for all-around peace of mind.

Why Do You Need CTPL Insurance?

- Legal Compliance CTPL is required by the Land Transportation Office (LTO) for vehicle registration and annual renewal.

- Financial Protection It covers costs related to third-party injuries or accidental deaths, helping you avoid major out-of-pocket expenses.

- Peace of Mind Drive worry-free knowing you’re protected from unexpected legal and financial liabilities.

CTPL Insurance - Frequently Asked Questions

What is CTPL Insurance?

CTPL (Compulsory Third Party Liability) insurance is a mandatory policy in the Philippines that covers injuries or death caused to a third party (not the driver) due to a vehicular accident.

Is CTPL Insurance enough for my vehicle?

CTPL only covers third-party bodily injuries or death. It does not cover your own vehicle’s damage, theft, or natural disasters. For full protection, consider a comprehensive insurance policy.

How long does it take to get my CTPL policy?

With ZenInsure, your CTPL policy is typically issued within minutes after completing your details and payment online.* (*Subject to successful document verification.)

Can I renew my CTPL Insurance online?

Yes! Just click the “Renew Insurance” button on our platform. You’ll be guided step-by-step through a fast and secure renewal process.

What happens if I drive without CTPL Insurance?

Driving without valid CTPL Insurance is illegal in the Philippines. It may result in:

- LTO registration issues

- Penalties and fines

- Delays in your vehicle renewal process

How can I file a CTPL Insurance claim?

To file a claim:

- Contact your insurance provider immediately.

- Prepare documents: police report, medical records, receipts, and any other supporting documents.

- Submit your claim to the insurer.

- Follow up for claim updates until resolved.

CTPL Insurance Tips, Trends & Stories

CTPL Insurance Made Easy with ZenInsure

Stay Compliant. Stay Protected.

Compulsory Third Party Liability (CTPL) Insurance is a mandatory requirement by the Land Transportation Office (LTO) for all vehicle registrations and renewals in the Philippines. ZenInsure makes it fast, easy, and hassle-free to get your CTPL policy online - no long lines, no unnecessary paperwork.

CTPL protects third parties - pedestrians or passengers - in the event of an accident caused by your vehicle. While it doesn’t cover damage to your own vehicle, it ensures you meet legal requirements and provides essential coverage for bodily injury or death involving others.

Why Choose CTPL from ZenInsure?

- LTO-Required Coverage – Fully compliant with government regulations

- Instant Policy Issuance – Delivered directly to your inbox

- Digital Convenience – online process, no physical visit needed

- Trusted Insurance Partners – Backed by licensed and reliable providers

What Does CTPL Cover?

CTPL provides protection for:- Bodily injury or accidental death of a third party due to a vehicular accident

- Legal liabilities and defense costs related to the incident

Coverage Limit:

Up to ₱100,000 as mandated under standard CTPL policiesNote: CTPL does not cover property damage, the vehicle owner, or passengers. For broader protection, consider upgrading to a Comprehensive Insurance plan through ZenInsure.

How It Works

Getting CTPL through ZenInsure is simple:- Fill in your vehicle details – Plate number, chassis number, etc.

- Choose your insurer – From our list of LTO-accredited partners

- Make payment online – Secure and seamless

- Receive your policy – Instantly via email, ready for your LTO registration

Get CTPL Insurance Today – The Zen Way

Don’t risk delays or penalties. With ZenInsure, you get fast, affordable, and fully digital CTPL Insurance - trusted by thousands of Filipino vehicle owners.

Drive with confidence. Register without hassle.

Get your CTPL Insurance now with ZenInsure.